Embarking on an e-commerce journey, you might ponder, “do I need a business license to sell on Amazon?” It’s imperative to sift through the layers of local and state regulations which impact your path to becoming an Amazon entrepreneur. Although Amazon itself may not explicitly demand a business license, navigating the minefield of selling on Amazon license requirements is essential. To operate within the law’s bounds, it pays to be informed about the Amazon seller regulations and the necessary permits, particularly if your product niche requires it.

Whether you’re dealing in everyday items or specialty products, understanding and adhering to your area’s specific mandates will enhance your credibility and fortify the foundation of your online business. Let’s delve into what’s required of you, from obtaining a sales tax license to recognizing when a seller’s permit becomes a must-have for your Amazon storefront.

Key Takeaways

- Amazon may not need a business license, but your state and local jurisdiction might.

- Consider if your product is regulated; licenses may be crucial for legal operations.

- Stay updated on Amazon seller regulations to ensure compliance.

- A seller’s permit is often necessary for tax purposes, especially if you have an in-state customer base.

- Familiarize yourself with the implications of not having proper licensure—financial penalties can hobble your business.

Understanding the Amazon Marketplace and Seller Requirements

Gaining a foothold in the Amazon landscape means more than just listing your products; it’s about comprehending and adhering to a specific set of Amazon seller requirements. As such, it’s essential for you to seamlessly integrate into Amazon’s ecosystem while staying within the legal boundaries of your own jurisdiction. Legal awareness isn’t just a nicety—it’s a necessity to maintain your selling privileges and protect your business from potential pitfalls.

The Importance of Compliance for Amazon Sellers

To thrive on Amazon, familiarizing yourself with the legal requirements for selling on Amazon is crucial. This isn’t merely a recommendation; it’s pivotal to your longevity and success on the platform. The legal landscape encompasses a myriad of regulations, and failure to comply can lead to harsh consequences, including account suspension, fines, or even legal action. Therefore, it’s incumbent upon you to discern and fulfill these requirements diligently.

Navigating the Different Types of Products on Amazon

Amazon’s vast marketplace includes an array of product categories, with each harboring its own set of rules and restrictions. To safely navigate this complex terrain, understanding the permits for selling on Amazon concerning specific product types is non-negotiable. This knowledge is especially crucial if you’re venturing into areas involving hazardous materials or other regulated goods. Stay informed and ensure that your product listings are not only optimized for sales but also unassailable in their adherence to Amazon’s stringent product policies and regional legalities.

- Research and understand the permits and licenses required for your specific product category.

- Align your business practices with Amazon’s seller policies to prevent any disruptions in your selling activities.

- Maintain accurate records and take proactive steps to renew permits and licenses as needed.

By vigilantly staying on top of these requirements, you fortify your position as a reliable, law-abiding merchant amidst the competitive sphere of Amazon sellers.

Local and State Legalities: Do They Impact Your Amazon Business?

When you’re set on starting an online business on Amazon, the excitement of launching your store and watching your first sale roll in is palpable. But before diving headfirst into the Amazon marketplace, it’s essential to pause and consider how local and state legalities might play a role in your new venture. It’s not just about having a keen business sense; it’s also about ensuring that you handle the required licenses for selling on Amazon with due diligence.

Let’s break down precisely what you might need to start on the right legal footing:

- Business License: Depending on where your home base is, you may need a general business license to operate lawfully. This is especially true if you’re operating your business from home, which most online sellers do.

- Seller’s Permit: Many states will require you to obtain a seller’s permit (also known as a sales tax permit) to collect sales tax from your customers. This is a crucial license as it allows you to handle state-specific sales tax.

- Other Special Permits: If you’re dealing with specific types of products, such as those that are highly regulated (food, health-related items, etc.), you might need additional permits.

Your business’s nature and location are the key determinants of the licenses and permits required. Conduct thorough research or consult with a legal expert to ensure you cover all bases. It’s crucial to have these requirements dialed in to avoid any legal hiccups that might disrupt your business flow. While paperwork can seem daunting, it is a foundation that supports the more exciting aspects of your Amazon venture.

Remember, each state has its own set of rules, and staying on top of these will help you avoid penalties or even the shutdown of your Amazon store. Tailoring your business to align with these legalities is part and parcel of setting up a successful online enterprise on one of the world’s most dynamic e-commerce platforms.

Exploring Federal vs. State Business License Requirements

When you’re diving into the intricate world of online selling, particularly with giants like Amazon, understanding the difference between federal and state license requirements for e-commerce is crucial. Your journey as an e-commerce entrepreneur will intersect with various regulatory paths, and it’s important to know the terrain. This understanding can impact several facets of your Amazon business, from the legitimacy of your operations to your relationship with federal and state agencies.

The Role of the Small Business Administration (SBA) in Licensing

Navigating business licenses can seem daunting, but you don’t have to go it alone. The Small Business Administration (SBA) is a valuable resource that can help demystify federal and state licensing for your Amazon business. The SBA provides a wealth of information and tools that can guide you through the process of obtaining the necessary business license for e-commerce. They can also advise you on the kinds of permits that may be required for certain business activities.

Identifying If Your Product Categories Require Federal Oversight

Have you considered the type of products you plan to sell on Amazon? Some categories might fall under federal oversight. Here’s where due diligence comes into play. Make sure you take the time to understand whether the products you want to market are governed by specific federal agencies or if they’re generally regulated at the state level. This distinction can greatly alter the licenses or permits you’ll need to legally sell through Amazon.

- Check for any special federal regulations related to your product categories.

- Understand how state-level regulations can impact your e-commerce operations.

- Consult with federal and state agencies or use SBA resources to ensure compliance.

Gaining clarity on whether an Amazon business license is dictated by federal or state guidelines is a vital step to set your Amazon storefront up for success. Always stay updated with the latest regulations to confidently navigate the e-commerce landscape and maintain the integrity of your burgeoning business.

Do I Need a Business License to Sell on Amazon?

As an Amazon seller, you might wonder about the intricacies of legal compliance when it comes to licenses and permits. The major question that looms large is “do I need a business license to sell on Amazon?” While the platform itself does not mandate this, your duty to adhere to local regulations cannot be ignored. In essence, selling on Amazon can be structured to enhance your profitability while still ensuring that you remain on the right side of the law.

Amazon’s Policies on Business Licenses

Amazon is a juggernaut in the online marketplace, welcoming sellers from myriad backgrounds. Their policies on business licenses are quite straightforward: they don’t require one. However, they strongly suggest that you familiarize yourself with and abide by the laws that apply specifically to your business. This could entail acquiring a selling on Amazon business license if your local or state jurisdiction says you need one.

Seller Permits: Are They Necessary for Your Amazon Store?

Pushing beyond Amazon’s requirements, let’s talk about seller permits. Although not always federally required, securing a seller’s permit or reseller’s license can be a smart move. These permits are particularly crucial if you wish to purchase products wholesale tax-free and then collect sales tax from your end customers. Now, if you’re using Amazon’s Fulfillment by Amazon (FBA) service, it’s essential to ascertain whether Amazon takes care of sales tax collection for you, or if it’s your responsibility to manage sales tax compliance.

- If you need a seller’s permit, this depends largely on your operational footprint and the nature of the goods you’re selling.

- Understanding the complexities of tax law in relation to your e-commerce activities can save you from potential legal headaches and financial penalties down the line.

- Staying informed about the tax remitting services Amazon provides for FBA users can markedly simplify your operational workflow.

Tackling the question, “do I need a business license to sell on Amazon?” starts with an assessment of your business model against the backdrop of the regional legal landscape. Properly navigating this terrain will ensure you maintain the integrity of your online store and foster a thriving, sustainable business on Amazon.

Does Selling in Specific States Require Different Permits?

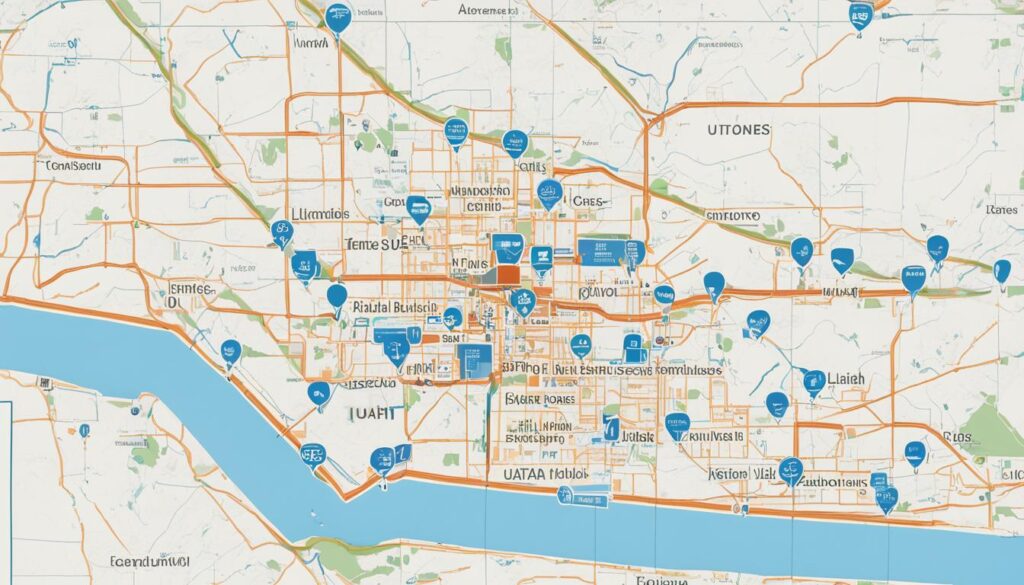

As you navigate the complexities of becoming an Amazon seller, it’s important to be aware that permits for selling on Amazon may vary from state to state. If you’re using Amazon’s Fulfillment by Amazon (FBA) program, the “nexus” factor could require you to obtain a sales tax permit in certain states. Understanding the Amazon seller regulations related to this is key to operating within the law.

The concept of nexus—and its implications for your business—means having a physical presence in a state, such as through inventory storage in Amazon’s warehouses, which could potentially obligate you to collect, account for, and remit sales tax. Let’s delve into what you need to consider:

- Identify states where your goods are stored and shipped from, as this establishes a physical presence, or nexus.

- Check if those states require a sales tax permit for out-of-state sellers using warehouse facilities.

- Stay updated with ongoing changes in state tax laws to ensure you remain compliant.

- Understand that even if your business is not based in a state with a nexus, you still may need to comply with that state’s tax code.

This information is vital because each state has its own set of rules and failing to comply can have serious financial repercussions. Always do your due diligence or consult a tax professional to ensure you have the necessary permits to conduct your Amazon business worry-free.

Forming an LLC: Advantages for Amazon Sellers

If you’re venturing into the world of online commerce as an Amazon business owner, considering the structure of your venture is crucial. One option that stands out with a host of benefits is forming a Limited Liability Company (LLC). Understanding the benefits of forming an LLC can help you protect your interests and cement your professional credibility among customers and competitors alike.

Limited Liability and Protecting Personal Assets

One of the standout benefits of forming an LLC for your Amazon business is the legal protection it affords. As an LLC, your personal assets are safeguarded in the event that your business encounters legal hardships. This means your personal savings, property, and other assets won’t be at risk if your business runs into debt or legal claims. For you, this translates into peace of mind, allowing you to focus on growing your business on a steady foundation.

Enhancing Your Professional Credibility on Amazon

Establishing an LLC not only offers a layer of financial protection but also significantly boosts your professional image. Customers on Amazon generally tend to trust LLCs more; they see them as more established and committed. This can be pivotal for standing out in a competitive marketplace. Furthermore, suppliers and financial institutions often prefer to do business with legally recognized entities, which can streamline the process of scaling your operation and securing beneficial partnerships.

- Separation of personal and business finances helps in easier tax preparation and financial management.

- LLCs are often eligible for tax benefits that sole proprietorships are not, potentially lowering your tax obligations.

- The enhanced trust factor with consumers can lead to increased sales and customer loyalty.

Building your Amazon business as an LLC can set the stage for a more secure and credible future. By taking advantage of the protections and esteem offered by this business structure, you position yourself to maximize the success of your entrepreneurial pursuits.

What is the Nexus and How Does It Affect Sales Tax Collection?

As you embark on your venture with Amazon FBA, understanding the intricacies of the nexus concept is essential. The term ‘nexus’ can sound complicated, but it simply refers to the connection your business has to a state, compelling you to comply with its sales tax obligations.

Understanding the Nexus Concept and Tax Obligations

The nexus is often triggered by specific business activities, for instance, storing inventory in a state—something very common if you use Amazon FBA. When you have a nexus in a state, you’re required to collect and remit sales tax for sales to customers in that state. So if your goods are sitting in a warehouse in Texas, you’re looking at fulfilling Texas sales tax laws.

Amazon’s FBA Service and Sales Tax Implications

For Amazon FBA sellers, this becomes particularly important. Amazon’s network of fulfillment centers can distribute your inventory across multiple states, inadvertently creating nexus for you. Keeping track of where your inventory is located allows you to register and file sales taxes accordingly. In some cases, Amazon does the heavy lifting of collecting and remitting sales taxes for you, but staying informed ensures you never fall foul of tax authorities.

- Know the states where your Amazon FBA inventory is stored.

- Understand the nexus laws of each state.

- Collect and remit sales taxes for those states, or ensure Amazon does on your behalf.

- Stay updated on changes to tax laws that could impact your e-commerce business.

In summary, getting a grip on the nexus concept and how it affects your Amazon FBA business helps you stay compliant with sales tax obligations, ensuring your e-commerce journey is smooth and legally sound.

Setting Up a Professional Seller Account on Amazon

Embarking on your journey as an Amazon merchant brings with it a crucial decision: the choice between an individual vs. professional selling plans. If you are someone eyeing the large-scale potential of the e-commerce behemoth, setting up a professional seller account on Amazon is likely your best bet. Unlike individual sellers, professional sellers tend to deal with a higher volume of sales, which necessitates a more structured approach to online commerce.

A professional seller account on Amazon incurs a monthly fee. However, with this comes a suite of benefits geared towards serious sellers aiming to expand their business. Some perks of opting for a professional seller account include access to advanced selling tools, eligibility for top placement on product detail pages, and the ability to offer promotions and gift services.

- Bulk listing and inventory management capabilities

- The opportunity to sell in more than 20 product categories

- Use of Amazon’s Marketplace Web Service

- Eligibility for featured merchant status

- Access to detailed business reports and analytics

When considering an upgrade from an individual account, it’s essential to weigh these features against your business goals. Professional accounts are designed for sellers with the ambition to generate substantial sales numbers and grow a scalable online presence.

Furthermore, opting for a professional seller account on Amazon conveys a message of seriousness and legitimacy to consumers and gives you a competitive edge. You’ll find that managing your finances also becomes more streamlined, allowing for a clearer financial overview of your burgeoning enterprise. In essence, your Amazon professional seller account acts as a robust foundation for building and nurturing your online business into a successful and recognizable brand.

Wise Business: Streamlining Finances for Amazon Sellers

As an Amazon seller, you’re always looking for ways to simplify the financial aspects of your international sales. Wise Business emerges as a game-changer, providing tools that cater specifically to your needs, allowing you to efficiently manage multi-currency transactions and get the most out of your global business.

Features of Wise Business That Benefit Amazon Entrepreneurs

Wise Business comes equipped with a plethora of features designed to make your life easier. Imagine having the ability to receive payments in several foreign currencies and convert them with real mid-market exchange rates. Wise Business not only offers this but also integrates with your preferred accounting software for seamless financial management.

- Local currency accounts in major markets

- Instant and affordable currency conversion

- Direct integration with accounting platforms

- Batch payments to save time on multiple transactions

International Sales and Multi-Currency Transactions on Amazon

When your business transcends borders, dealing with foreign currencies becomes an integral part of the day-to-day operations. Wise Business is incredibly beneficial for handling multi-currency transactions, whether you’re paying suppliers or receiving payments from customers worldwide. Enjoy the peace of mind that comes from cost-effective and transparent transactions, ensuring that your international sales flourish without unnecessary financial burdens.

- Receive payments in various currencies like USD, GBP, EUR, and more.

- Access real-time exchange rates for precise financial planning.

- Utilize the multi-currency debit card for worldwide spending and withdrawals.

Wise Business for Amazon sellers is indeed a cornerstone for success in today’s global marketplace. It streamlines your financial operations so you can focus on growing your business and reaching customers across the globe.

Conclusion

Embarking on the e-commerce voyage with an Amazon storefront brings its fair share of legal considerations into play. As we’ve explored throughout this Amazon seller’s guide, whether you require a business license for e-commerce hinges on your location, what you’re selling, and the volume of your sales. It’s not just about obeying Amazon’s rules; it’s about ensuring that your business stands on solid legal ground. And remember, while Amazon does not directly necessitate sellers to have a business license, navigating your state and local legal requirements is a critical step in establishing and maintaining a successful online store.

Forming an LLC for your Amazon business isn’t just about professionalism; it’s a protective measure for your personal assets and a step towards establishing credibility with customers. Moreover, grasping the intricate details of the nexus concept is indispensable, particularly if you are utilizing Amazon’s FBA service. Sales tax collection and remittance are nuanced topics that demand your attention to prevent unwanted legal scrutiny. It’s imperative you understand these obligations and align your business practices accordingly to avoid potential complications.

Lastly, financial management remains a cornerstone of any thriving business, and tools like Wise Business are invaluable in optimizing operations. They offer solutions tailored for the global market with features that support multi-currency transactions, beneficial to Amazon sellers reaching an international audience. As you wrap up this guide, it’s clear that preparation, knowledge, and the right resources will serve as pillars of success for your e-commerce endeavors on Amazon. It is also evident that selling online can be a fruitful venture when approached with diligence and informed decision-making.

Wise Business: Streamlining Finances for Amazon Sellers

What are the legal requirements for selling on Amazon?

While Amazon does not require its sellers to have a general business license, you must comply with all federal, state, and local laws pertaining to business licensing and permits, which vary according to what products you’re selling and your operational location.

Do I need specific permits for selling different types of products on Amazon?

Yes, some product categories may require special permits, particularly if they are regulated goods like food, cosmetics, or health products. Be sure to research the specific regulations that apply to the products you plan to sell.

Are there required licenses for selling on Amazon depending on my state?

Yes, depending on your state, you may need a business license, a seller’s permit, or other specific permits to operate legally. It’s critical to check with your local and state agencies to understand your business’s legal requirements.

Does selling on Amazon necessitate federal licensing?

Most online retail activities don’t require federal licenses. However, if you’re selling products that are under federal regulation, such as firearms, alcohol, or tobacco, you will need the appropriate federal permits.

Do Amazon’s policies require sellers to obtain business licenses?

No, Amazon’s policies do not mandate sellers to have business licenses, but you must adhere to your local, state, or federal regulations. Always check your area’s requirements to ensure compliance.

Are seller permits necessary for your Amazon store?

A seller’s permit, which allows you to collect sales tax from customers, is often necessary if you are conducting business within states that require you to collect and remit sales tax. Such requirements can vary significantly from state to state.

Can selling in different states affect the permits I need for my Amazon business?

Absolutely. Each state has its own tax laws and business regulations. For example, if you store your inventory in Amazon warehouses across different states, through the FBA program, you may create a ‘nexus’ that requires you to collect sales tax in those states.

What are the benefits of forming an LLC for an Amazon business?

Forming an LLC for your Amazon business provides limited liability protection, which safeguards your personal assets from business debts. It also enhances your professional credibility, can improve customer trust, and may offer tax benefits.

What is the nexus concept, and how does it relate to my Amazon business?

The nexus concept refers to your business having a substantial presence, like inventory storage, in a state due to Amazon FBA, which may obligate you to collect sales tax in that state. Staying informed about where Amazon houses your products is crucial for managing your tax responsibilities.

Should I set up a professional seller account on Amazon?

If you anticipate making more than 40 sales a month and wish to access additional selling tools, it’s advisable to set up a professional seller account. This comes with a monthly fee but offers the potential for a more scalable business model.

How can Wise Business help Amazon sellers with their finances?

Wise Business offers financial management tools for Amazon sellers, including multi-currency accounts for international sales, integration with accounting software, and features like batch payments. It provides transparent and real-time exchange rates, which can be cost-effective solutions for handling global transactions.