Starting a business in Utah is thrilling. The state has a strong job market and supports businesses well. Knowing the Utah business license cost is key. Some businesses need special permits based on their type and where they’re located.

Getting a license in Utah means following steps at both local and state levels. The cost to register your business in Utah changes based on what you do and where you do it. Make sure to look into the fees for your business type to follow the law and avoid unexpected costs.

Key Takeaways

- Utah’s business-friendly climate attracts entrepreneurs

- Licensing requirements vary by industry and location

- Utah business license costs differ across municipalities

- Research local and state regulations for accurate fee information

- Proper licensing ensures legal compliance for your business

Understanding Utah Business License Requirements

Starting a business in Utah means you have to follow certain rules. You don’t need a statewide business license, but you must follow local and state laws. Let’s look at what you need to know about Utah business licenses.

General Business Operating Licenses

Most places in Utah require a general business operating license. These licenses make sure your business follows local rules. You should talk to your local government to find out what permits you need.

Industry-Specific Licenses and Permits

Some businesses need special licenses. For instance, restaurants need health permits, and contractors need professional certifications. Make sure to check what your industry requires to avoid legal problems. Knowing the local laws is key for running your business smoothly.

State-Level Registrations

Utah also has state-level registrations for businesses. These include:

- Sales tax registration for businesses selling goods

- Professional licensing for certain jobs

- Environmental permits for businesses that affect nature

By doing your homework and following Utah’s business license rules, you’ll build a solid base for your business. Always keep up with changes in laws to keep your business legal.

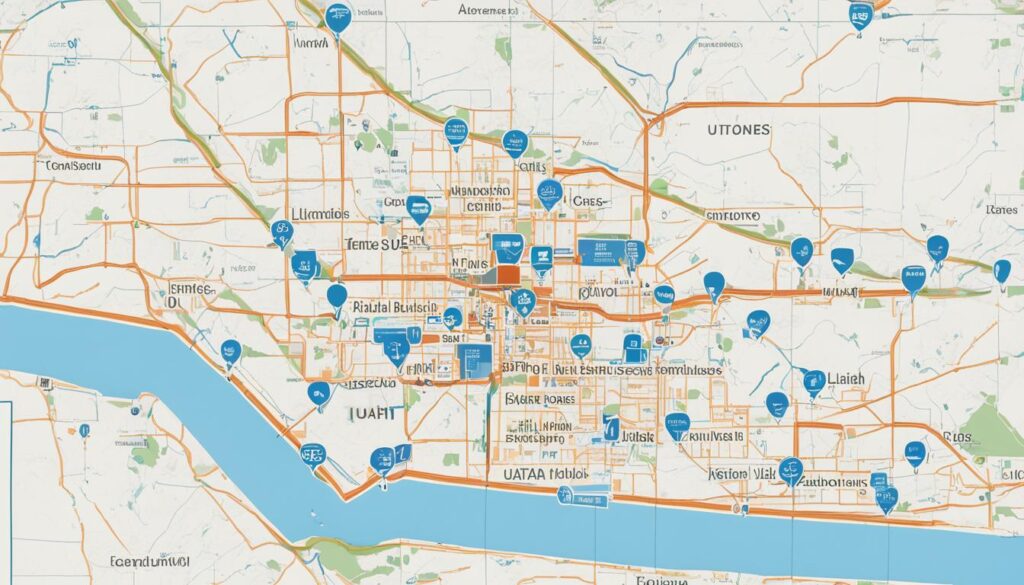

Local Business Licenses in Utah Cities and Counties

Starting a business in Utah means you need to know about local licenses. These requirements change from city to city and county to county. It’s important to understand these differences, whether you’re getting a Utah sole proprietorship license or figuring out your Utah LLC formation cost.

Salt Lake City Business Licensing

In Salt Lake City, all businesses must have a city business license. You can get this license through the city’s official website. The cost depends on your business type and size. Don’t forget to include this in your Utah LLC formation cost if you’re setting up in Salt Lake City.

Utah County Licensing Fees

Utah County has its own fee for business licenses. They charge a flat fee of $150 plus more for each employee. This can affect your startup costs, especially if you’re thinking about a Utah sole proprietorship license in this area.

Variations in Local Licensing Requirements

Local licensing needs can change a lot across Utah. Some cities have stricter rules or higher fees than others. It’s important to talk to your city or county clerk for the right info on licensing and costs. Knowing these local rules is crucial to make sure your business is legal and avoids fines.

- Check your city’s official website for licensing info

- Talk to your local county clerk for specific needs

- Plan for licensing fees in your startup budget

How Much Is a Utah Business License?

The cost of a Utah business license depends on where you are and what kind of business you have. Each city and county in Utah has its own fees and rules for business licenses.

In Salt Lake City, you’ll pay a $100 fee to apply for a new business license. Utah County charges $150 plus more for each employee. Other places might have different prices or need special licenses for certain types of businesses.

Utah business taxes are different from licensing fees. You must register for a sales tax permit if you sell goods or certain services. This permit is usually cheap, but you’ll have to collect and send sales tax to the state.

To find out the exact cost for your business, talk to your local city or county office. They can tell you about the Utah business license cost in your area. Remember, selling on platforms like Amazon might need extra fees based on your products and business setup.

- Check with your local government for exact fees

- Budget for both license costs and ongoing tax duties

- Consider extra permits based on your business activities

Knowing all about licensing and taxes will help you prepare to start and run your Utah business well.

State-Level Licenses and Permits in Utah

Utah small business permits depend on your industry and where you’re located. It’s key to know the state-level rules to legally run your business in Utah. We’ll look into the main permits and licenses you might need.

Sales Tax Registration

If you sell goods or services in Utah, you must get a sales tax license. This is called a seller’s permit and comes from the Utah State Tax Commission. Luckily, there’s no fee for this permit.

Professional Licensing

Some jobs in Utah need special licenses. The Division of Professional Licensing checks on these. Make sure your job needs a license to avoid fines. Jobs that often need licenses include:

- Healthcare providers

- Real estate agents

- Contractors

- Cosmetologists

Environmental Permits

Some businesses need environmental permits. The Utah Department of Environmental Quality gives these out. For instance, if your business deals with wastewater, you’ll need a permit. Check what your business needs to follow Utah’s environmental laws.

Remember, costs for Utah business registration and permits can pile up. Plan for these when starting your business. Keep up with your industry’s rules to run your business well in Utah.

Federal Licensing Requirements for Utah Businesses

Most small businesses in Utah don’t need federal licenses. But, some industries do require special permits. If you’re starting a business in a regulated field, knowing these rules is key.

Here are some industries that might need federal licenses:

- Agriculture

- Alcoholic beverage sales

- Aviation

- Firearms

- Fish and wildlife

- Maritime transportation

- Mining and drilling

- Nuclear energy

- Radio and television broadcasting

- Transportation

If your business is in one of these areas, make sure to check the federal rules. This is important, along with getting your Utah business license and paying any fees.

Remember, federal licenses are different from state and local ones. You must apply for these on your own. Not getting the right federal permits can lead to big fines or even closing your business. Always talk to a lawyer if you’re not sure about what you need.

Steps to Obtain Your Utah Business License

Getting a Utah business license is a few steps. First, you form your business entity. Then, you secure the needed permits. Let’s go through these steps to help you get your license.

Form Your Business Entity

First, pick a business structure. Forming a Utah LLC costs $70, which is pretty cheap. If you pick another type, the fee will be different.

Get an EIN

Then, get an Employer Identification Number (EIN) from the IRS. This is key for taxes and hiring staff. If you’re the only owner, you can use your Social Security Number.

Apply for Licenses and Permits

Next, apply for your local business license. Your city or county office will tell you what you need. Also, register for sales tax with the Utah State Tax Commission if you sell things.

Some businesses need extra licenses. Make sure you check your industry for all the rules. By doing this, you’ll be ready to legally run your business in Utah.

Renewing Your Utah Business License

It’s vital to keep your Utah business license current for legal reasons. Renewal times vary by business type and location. Most licenses must be renewed by January 31 each year. This process links to Utah business taxes and small business permits.

Annual renewal deadlines

Remember January 31 as the key date for most Utah business license renewals. Start early to avoid last-minute stress. Renewing on time keeps your business legal and saves you from fines.

Late renewal penalties

Missing the deadline can cost you a lot. Late fees go up over time. A 25% fee applies after January 31, rising to 50% by February 28, and 100% by March 31. By April 30, the penalty is 200%. If you haven’t renewed by May 1, a Sheriff’s Officer might visit to check if you’re still open. They could fine you for not having a license. Avoid these big fees and legal issues by staying on top of your renewals.

FAQ

What are the general business licensing requirements in Utah?

Do I need a business license to operate in Salt Lake City?

How much does a business license cost in Utah?

Do I need to register for sales tax in Utah?

Are there any federal licensing requirements for Utah businesses?

What are the steps to obtain a Utah business license?

How often do I need to renew my Utah business license?

Author

-

David Nguyen is an expert in business licensing, with extensive knowledge in local and international regulations. His expertise is crucial for businesses seeking guidance on compliance and licensing strategies.

View all posts