Freelancing can be complex when it comes to business licenses. You might ask yourself, “Do I need a license to work?” The answer changes based on where you are and what you do. It’s not always clear-cut.

Some freelancers might not need any permits. Others could need licenses from their city, state, or professional groups. It’s key to know the legal rules for freelancers in your area before starting. This can prevent fines, suspensions, or legal trouble later.

You might come across local licenses, professional permits, and occupational licenses. Getting these sorted out before you start can prevent problems later. Being ready with your freelance business licenses is always wise.

Key Takeaways

- Freelance business licenses vary by location and profession

- Some freelancers may not need any licenses

- Local, professional, and occupational licenses are common types

- Research your specific requirements before starting your business

- Proper licensing can help avoid fines and legal issues

- Getting licenses early can save you trouble in the long run

Understanding Freelance Business Licenses

As a freelancer, knowing about business licenses is key. These licenses let you legally run your business. Let’s dive into the main points of freelance business licenses.

What Is a Business License?

A business license is easy to understand. It’s a document that lets you operate your business in a certain area. For freelancers, this area could be your city, county, or state. The license proves you’re following the local rules.

Types of Licenses for Freelancers

Freelancers might need different licenses. These include:

- General business license

- Professional license for specific fields

- Home occupation permit

- Sales tax permit

The licenses you need depend on where you work and what you do. Freelance writers may need specific licenses based on their services and location.

Why Compliance Matters

Staying compliant is vital for freelancers. It prevents legal issues and fines. It also makes you look more professional to clients. With the right licenses, you show you’re serious. This can open up more business chances and build a strong reputation.

Factors Determining the Need for a Business License

Starting your self-employment journey means understanding what you need for a business license. Many things affect if you must get a license as a freelancer or independent contractor.

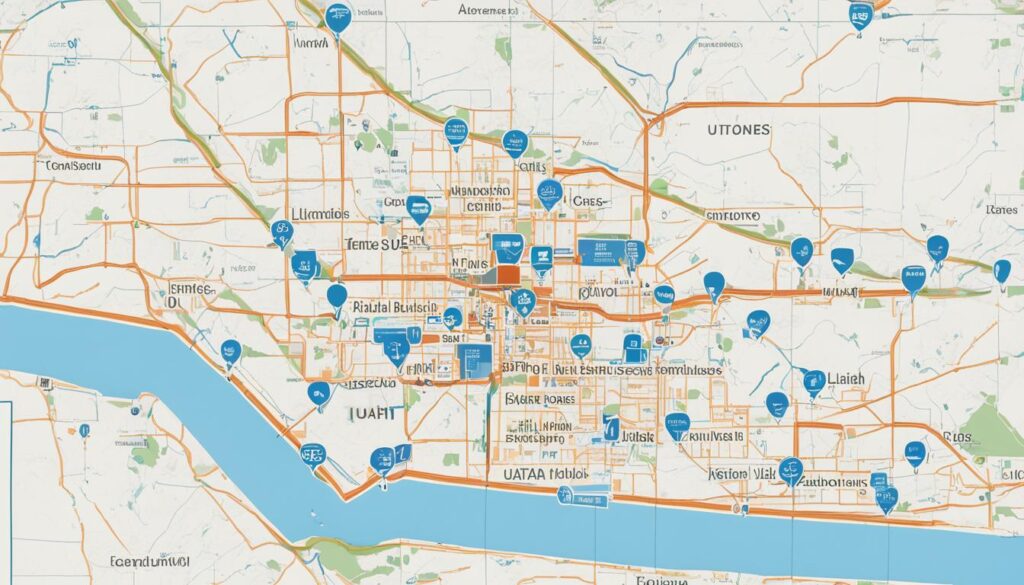

Your location is key in deciding if you need a license. Some places require licenses for home businesses, while others don’t. Make sure to check local rules to follow the law.

The kind of freelance work you do matters too. Some jobs like healthcare, finance, and real estate need special licenses. For instance, graphic designers might need different licenses than accountants working on their own.

How much you earn and how your business is set up also play a part. Some places make you get a license if you earn over a certain amount. Whether you’re a sole proprietor or an LLC can also change your licensing needs.

- Location-specific regulations

- Nature of your freelance work

- Income thresholds

- Business structure (sole proprietorship, LLC, etc.)

Think about these things to see if you need the right licenses for your freelance work. Knowing your local laws helps you work legally and professionally.

Do Freelancers Need a Business License?

Freelancers often ask if they need a business license. The answer varies based on different factors. Knowing these can guide you through registration and local laws.

Location Matters

Your location is key in deciding if you need a business license. Some places require permits for freelancers working from home. Make sure to ask your local government about what you need in your area.

Industry Requirements

Some fields like healthcare, finance, or legal services have strict licensing. It’s important to check the rules for your field. This ensures you follow the law and avoid fines.

Income and Business Structure

Your earnings and how your business is set up can affect if you need a license. Some places have rules based on how much you make. The type of business you have – like a sole proprietorship, LLC, or S-Corporation – also matters for licensing and taxes. Understanding these can help you work legally and efficiently.

- Check local regulations

- Research industry-specific requirements

- Consider income levels and business structure

By looking into these areas, you’ll be ready for your freelance permits and taxes. Staying legal not only keeps you out of trouble but also makes you more trustworthy to clients.

Local and State Licensing Requirements

Freelancers need to navigate local and state licensing rules. Each place has its own set of rules. It’s important to know what applies to you.

City and County Licenses

Even home-based freelancers often need local business licenses. These licenses make sure you’re following the law in your area. Talk to your local government to find out what you need.

State-Specific Regulations

State rules for freelancers vary a lot. Some states require general business licenses, while others need permits for specific industries. For example, freelance designers might need a professional license in some states. Also, don’t forget about sales tax permits if you sell products.

Researching Local Requirements

Doing your homework on freelance permits is key. Begin by checking your city and county websites. Look for sections on business licensing or permits. If you can’t find it online, call your local government offices.

- Search official government websites

- Contact local business development centers

- Consult with other freelancers in your area

Zoning laws can impact home-based businesses. Some areas don’t allow certain activities in residential zones. Knowing and following local and state rules will help you build a strong freelance career.

Professional and Occupational Licenses for Freelancers

As a freelancer, you might need certain licenses or permits to work legally. These depend on your field and where you work. Many jobs require special certifications to keep quality high and protect customers.

Some common fields that need licenses for freelancers include:

- Healthcare (doctors, nurses, therapists)

- Financial services (advisors, accountants)

- Legal services (lawyers, paralegals)

- Architecture and engineering

- Real estate

To get these licenses, you usually have to register with national or state boards. This might mean passing exams, doing continuing education, and having malpractice insurance. Remember, the rules can change a lot between states and cities.

Don’t forget about occupational permits. They’re not as hard to get as professional licenses but are still important for following the law. For example, you might need a business tax certificate or a home occupation permit if you work from home.

Look into what licenses or certifications you need for your job and where you live. Being compliant not only keeps you legal but also makes you more trusted by clients and opens up more opportunities.

Benefits of Obtaining a Business License as a Freelancer

Getting a business license can really help your freelance career. Let’s look at how becoming a licensed freelancer can benefit you.

Legal Protection and Legitimacy

A business license gives you legal protection for your freelance work. It shows you’re serious about following the law. This can protect you from legal problems and give you peace of mind.

Increased Credibility with Clients

Having a license makes you more credible to clients. They’re more likely to trust and hire licensed freelancers. It shows you’re a pro who follows the rules. This can lead to more stable, long-term relationships with clients.

Access to Business Opportunities

A business license opens up new freelance opportunities. You can bid on government contracts or work with bigger companies. Some clients only hire licensed pros. By getting licensed, you’re opening up your potential client base.

Other benefits of getting a business license include:

- Proof of income for loan applications

- Easier tax filing and compliance

- Ability to open a business bank account

- Professional networking opportunities

A business license is more than just paperwork. It’s a tool that can help grow your freelance career. It helps you become a trusted professional in your field.

Steps to Obtain a Freelance Business License

Are you ready to make your freelance work official? Getting a business license is a smart choice. The business license application process might seem hard, but it’s achievable. First, look into your local rules. Each area has its own rules for freelance licenses.

Then, choose your business type. This could be a sole proprietorship, LLC, or corporation. After deciding, register your business name. Also, get any needed permits, like zoning or professional licenses. These requirements change based on your work type.

Next, apply for an EIN (Employer Identification Number) from the IRS. It’s like a social security number for your business. Open a separate bank account for your freelance work. If you’re forming an LLC, you might need an operating agreement. The steps can vary by location and your work type.

By following these steps, you’ll be on your way to a legit freelance business. It might take some time, but it’s worth it for the peace of mind and professional credibility you’ll gain.

FAQ

What is a business license?

What types of licenses are relevant for freelancers?

Why is compliance important for freelancers?

What factors determine if a freelancer needs a business license?

Do freelancers need a business license based on location?

Are there industry-specific licensing requirements for freelancers?

Can income thresholds and business structure affect licensing needs?

What are the benefits of obtaining a business license as a freelancer?

How can a freelancer obtain a business license?

Author

-

David Nguyen is an expert in business licensing, with extensive knowledge in local and international regulations. His expertise is crucial for businesses seeking guidance on compliance and licensing strategies.

View all posts