Amidst a sea of evolving markets, one nation stands out with an impressive leap of 38 ranks in the World Economic Forum Global Competitiveness Index over five years—welcome to the Philippines, a rising star with a projected 6.3 percent GDP growth rate by the Asian Development Bank. For savvy businesses eyeing global expansion, the time to hire employees in the Philippines could not be more opportune. This burgeoning economy is not just about figures; it’s about a vibrant workforce ready to plug into the global matrix.

With economic indicators promising a thriving future, the Philippines presents multifaceted employment opportunities for forward-thinking companies. The task of Philippines job hiring offers you a corridor to an English-speaking, young workforce, adept at navigating the demands of an international milieu. Whether you aim to recruit Filipino workers, find workforce in Philippines, or tap into outsourcing in the Philippines, aligning with the nation’s growth story can recalibrate your business trajectory. Efficient talent acquisition in Philippines means more than just expanding your team; it’s about integrating a workforce in tune with digital progress and agile business practices.

As an employer, to hire Filipino staff is to embrace a culture known for its hospitality and resilience. But beyond the cultural affinity lies the logistical ease. The Philippines’ commitment to fostering a healthy business environment is reflected in its progressive labor laws and competitive wage structures, making the job search in Philippines very attractive for employers and employees alike.

Key Takeaways

- The Philippines boasts a robust economic forecast with significant growth potential, making it a hotbed for talent.

- Capitalizing on the Philippines’ competitive advantage means accessing a skilled, English-speaking workforce.

- International businesses can harness various hiring methods, including direct employment and outsourcing.

- Understanding the country’s dynamic economic indicators, like the rise in the World Economic Forum Global Competitiveness Index, can inform strategic hiring decisions.

- Compliance with the local employment regulations ensures a smooth integration of Filipino workers into your business.

- Offering the right compensation and understanding the nuances of labor laws are keys to attracting and retaining top Filipino talent.

Understanding the Vibrant Labor Market in the Philippines

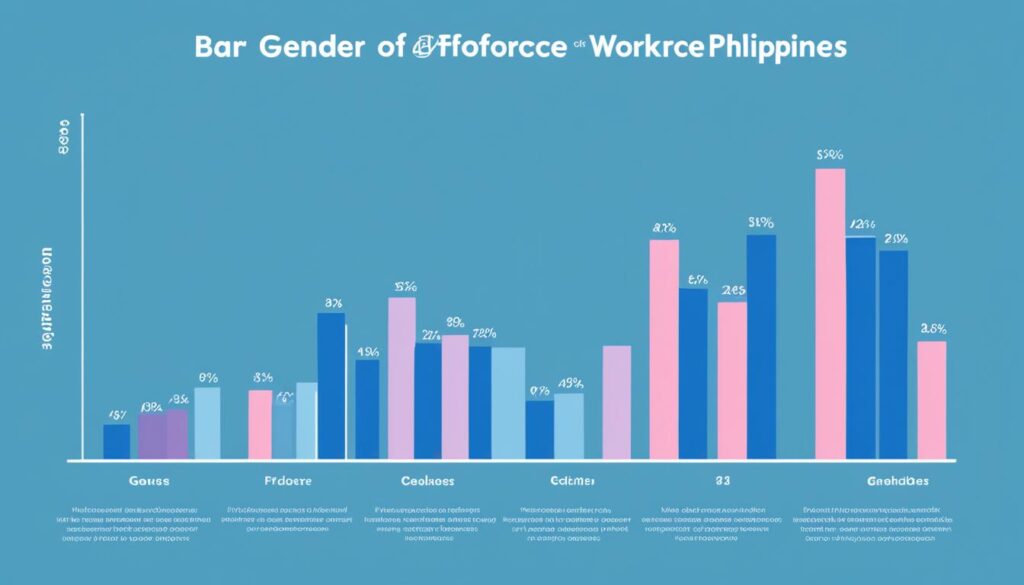

The Philippines stands out in Southeast Asia as an exemplar of dynamic economic growth and a robust labor market. With a GDP rocketing to USD 425 billion, international businesses are eyeing the Filipino workforce to capitalize on both the economic vitality and the highly skilled professionals that the Philippines offers. Yet, to make the most of these opportunities, comprehending the intricacies of labor market in the Philippines is crucial.

The Growing Economy and Its Implications for Hiring

As your company looks to the East for expansion, the economic growth in the Philippines provides a landscape ripe for investment. Recent statistics show that the employment rate stands impressively at 94.2%, reflective of the country’s burgeoning service sectors such as BPO (Business Process Outsourcing), tourism, and retail trade. In fact, these service sectors generated almost 80% of the new jobs in the region. With the Filipino workforce playing a significant role in this growth, the demand for labor continues to rise, leading to a competitive market for highly skilled workers. Yet, be mindful of the regional differences in minimum wages and an intricate calendar of 18 national holidays, impacting operational planning.

Why the English-Speaking Young Workforce is an Asset

Attracting global enterprises, the Philippines boasts a young, English-speaking workforce. With over half of the labor force possessing tertiary education, international employers find the high proficiency in English a monumental asset for global communication. Hence, whether it’s the thriving agricultural sector or the high-performing service industry, including a robust USD $9 billion BPO sector, tapping into this English-speaking pool is not just beneficial but necessary for international business growth and expanding global operations.

Compliance Essentials for International Employers

In the realm of expansion, hiring compliance cannot be overlooked. The Philippines presents its unique challenges and benefits—from ranking 27th globally for labor-employer cooperation to offering one of the longest maternity leaves in the world. Moreover, international employers in the Philippines have to navigate various legal considerations, with the rule of law ranking at 98 globally. It is imperative to understand the complexities of compliance, ranging from adhering to local minimum wages to ensuring alignment with the 13 public and bank holidays. Such diligence not only adheres to the law but also fosters a respectful and cooperative environment with the Filipino workforce.

Key Strategies to Hire Employees in the Philippines

As you consider expanding your company’s reach into Southeast Asia, the Philippines emerges as a strategic hub brimming with potential. But before tapping into this dynamic market, understanding the various strategies to hire in Philippines is fundamental. Whether you opt for establishing a legal entity in the Philippines, partnering with an employer of record, or hiring contractors in the Philippines, each approach carries its distinct benefits and risks of hiring models. Should your strategy lean towards engaging with global contractors in the Philippines, it’s crucial to navigate the intricacies of local employment laws.

Setting up a Legal Entity vs. Partnering with an Employer of Record

If your vision involves a long-term presence and direct oversight of your Filipino team, forming a legal entity in the Philippines may serve your interests best. This affords you full control but requires a deep understanding of the local business environment. Conversely, an employer of record can simplify your foray into this labor market. This intermediary handles all HR responsibilities, compliance requirements, and eases the operational burden, allowing you to focus on core business functions.

The Role of Contractors in the Philippine Hiring Landscape

Leveraging the expertise of contractors presents a flexible and project-focused hiring strategy. It’s a viable alternative when your business needs temporary or highly specialized skills. Nonetheless, it’s imperative to comprehend the statutory factors that distinguish an independent contractor from an employee in the Philippines, avoiding potential legal pitfalls related to misclassification.

Understanding the Benefits and Risks of Each Hiring Model

Each hiring avenue offers unique advantages and challenges. Building a legal establishment grants autonomy but comes with substantial financial and regulatory responsibilities. Employing an employer of record promises ease but may afford less control over your workforce. Engaging contractors ensures scalability and expertise, though it could expose you to compliance risks. Weigh these options against your business goals to secure the optimal balance for success in the Philippine market.

- Philippine laws, such as the Anti-Age Discrimination Act and the Data Privacy Act, protect candidates during the hiring process, ensuring ethical practices.

- Legislative protections including the Magna Carta for Persons with Disability and the HIV and AIDS Policy Act, mandate fair treatment for all job applicants.

- The Labor Code and decisions from the Philippine Supreme Court outline clear definitions and regulations for both permanent and fixed-term employment contracts.

- Recognize the advantages JobStart Philippines Act graduates bring to the table, demonstrating a commitment to bolstering local employment and skills development.

Comprehensive Guide to Employment Regulations and Compliance

When navigating employment regulations in the Philippines, it’s important for you to be informed and diligent to ensure full compliance for hiring in the Philippines. A thorough understanding of Filipino employment regulations can help safeguard your business from potential legal complications. Let’s delve into the critical areas you need to focus on.

If you are looking to expand your team, consider attending a webinar on employing for the first time and common workplace issues, providing you with a valuable primer on the intricacies of labor laws in the Philippines. Such sessions can clarify complex aspects like hours of work, wage standards, and addressing workplace issues.

- You must meticulously maintain written time and wage records for all employees and issue pay slips promptly, following the strict timelines set forth by labor laws in the Philippines.

- Advanced agreement on work hours and rostering between employers and employees is a cornerstone of international hiring compliance.

- Encourage clarity and fairness in your job advertisements, ensuring they are in alignment with the Fair Work Act and relevant fair work instruments.

Minimum employment terms and conditions are not arbitrary; they are derived from well-defined sources such as awards, registered agreements, and the National Employment Standards (NES). The Employment Contract Tool becomes indispensable if you’re hiring full-time, part-time, or casual employees under an award. This tool helps streamline the process of formalizing employment terms, reflecting the necessary employment regulations in the Philippines.

To set the stage for a successful working relationship, make sure you provide a comprehensive induction session for new hires. This ensures they are aware of expectations, work culture, and are provided with a structured training plan, which is a critical step in international hiring compliance.

For those entering into fixed-term contracts, there’s an obligation to provide a Fixed Term Contract Information Statement upon commencement – a key document under Filipino employment regulations. Considering the benefits of hiring apprentices or trainees could also enhance your workforce while fostering professional growth and development within your team.

Maintain healthy communication within your company through regular feedback sessions, an approach that not only aligns with compliance for hiring in the Philippines but also fosters a positive and proactive work environment. However, keep in mind the specific restrictions on fixed-term contracts, including limitations on the duration and number of renewals permissible under the labor laws in the Philippines.

- Prioritize employee records and pay slip issuance.

- Agree on work schedules in advance.

- Ensure job ads meet Fair Work Act requirements.

- Use the Employment Contract Tool for award-covered employees.

- Provide an induction session to new employees.

- Understand fixed-term contract regulations and benefits.

- Organize regular employee meetings for ongoing feedback.

Compliance is more than a set of rules—it’s an essential aspect of building a reputable and sustainable business in the Philippines. By adhering closely to the employment regulations in the Philippines, you position your business not only for legal security but also for ethical and fair practices that contribute to a thriving workplace culture.

Navigating Cost Factors When You Recruit Filipino Workers

Understanding the cost factors in recruiting Filipino workers is pivotal for businesses aiming to build an international team. A focus on payroll contributions in the Philippines, coupled with the appreciation of mandatory benefits in the Philippines, aids in creating a budget that aligns with legal requirements and competitive standards.

Payroll Contributions and Mandatory Employee Benefits

The financial commitment when hiring overseas extends beyond the surface of baseline wages. For Filipino workers, payroll contributions that encompass social security, health insurance, and housing pose essential segments of the compensation package. Additionally, mandatory benefits provide security and enhance the value proposition for prospective employees.

Deciphering the 13th-Month Pay and Additional Statutory Costs

Fiscal obligations such as the 13th-month pay, a gratuity mandated by Philippine law, equates to one full month of salary and influences annual budgeting. Employers must carefully navigate these and other statutory costs to maintain compliance and uphold workers’ rights – a crucial aspect of Filipino employment that cannot be overlooked.

Effective Salary and Benefits Structure to Attract Top Talent

To secure the most qualified professionals, developing an effective salary and benefits structure in the Philippines is crucial. This structure isn’t just about meeting the legal requirements for mandatory benefits, but also about providing a package that positions your company as an employer of choice in a competitive job market.

Your prudence in ensuring fair compensation and benefits, will not only assist in recruitment but also promote employee retention and satisfaction, guaranteeing the long-term success of your staffing endeavors.

Best Practices for Seamless Integration of Your Filipino Workforce

For businesses investing in the rich talent pool of the Philippines, achieving a seamless integration of the Filipino workforce is pivotal. When integrating Filipino employees, the nuances of cross-cultural communication become particularly significant. With a high percentage of Filipino organizations grappling with productivity challenges due to administrative inefficiencies, the introduction of comprehensive HRMS software has become a beacon of transformation. Such software catalyzes not only the recruitment process but also fortifies essential cultural assimilations that pave the way for effective team collaboration.

Understanding the complex tapestry of Filipino work culture is indispensable. Values like ‘pakikisama’ and ‘bayanihan’ are deeply woven into the professional environment and can be significant drivers for employee satisfaction and productivity. An impressive 85% of companies in the Philippines witnessed enhanced employee engagement and retention post the adoption of HRMS software. This is likely due to the dual benefit of offering employees an intuitive platform they are willing to engage with while also ensuring compliance with local labor laws—a must for fostering a secure work environment. Your organization can discover strategies to uplift employee productivity and streamline the recruitment process in the Philippines through resources such as this detailed blog post.

Moreover, with the backend analytics of modern HRMS software, businesses receive valuable insights into employee engagement, turnover, and tenure. This data is instrumental in measuring the success of integration strategies. Consistent application of these insights, coupled with HRMS software that ensures adherence to labor regulations and simplifies payroll, positions your organization to harness the full potential of your Filipino workforce. Embrace these best practices, and your business will not only align with the necessary legal frameworks but also create a productive, harmonious, and legally compliant workplace environment.